tn franchise and excise tax due date

If you have questions about Franchise And Excise Tax Online contact. Tennessee Department of Revenue Attention.

Franchise Excise Tax Consolidated Net Worth Election Applicaion Youtube

Taxpayer Services 500 Deaderick Street Nashville Tennessee 37242.

. However for the tax period ending December 31 2021 the due date is extended to April 18 2022 due to the. Interest and late filing. Annual 15th day of the 4th month following the close of your books and records.

For calendar year filers this date is April 15. Penalty The California Franchise Tax Board imposes a penalty if you do not pay the total amount due shown on your. This extension will automatically apply.

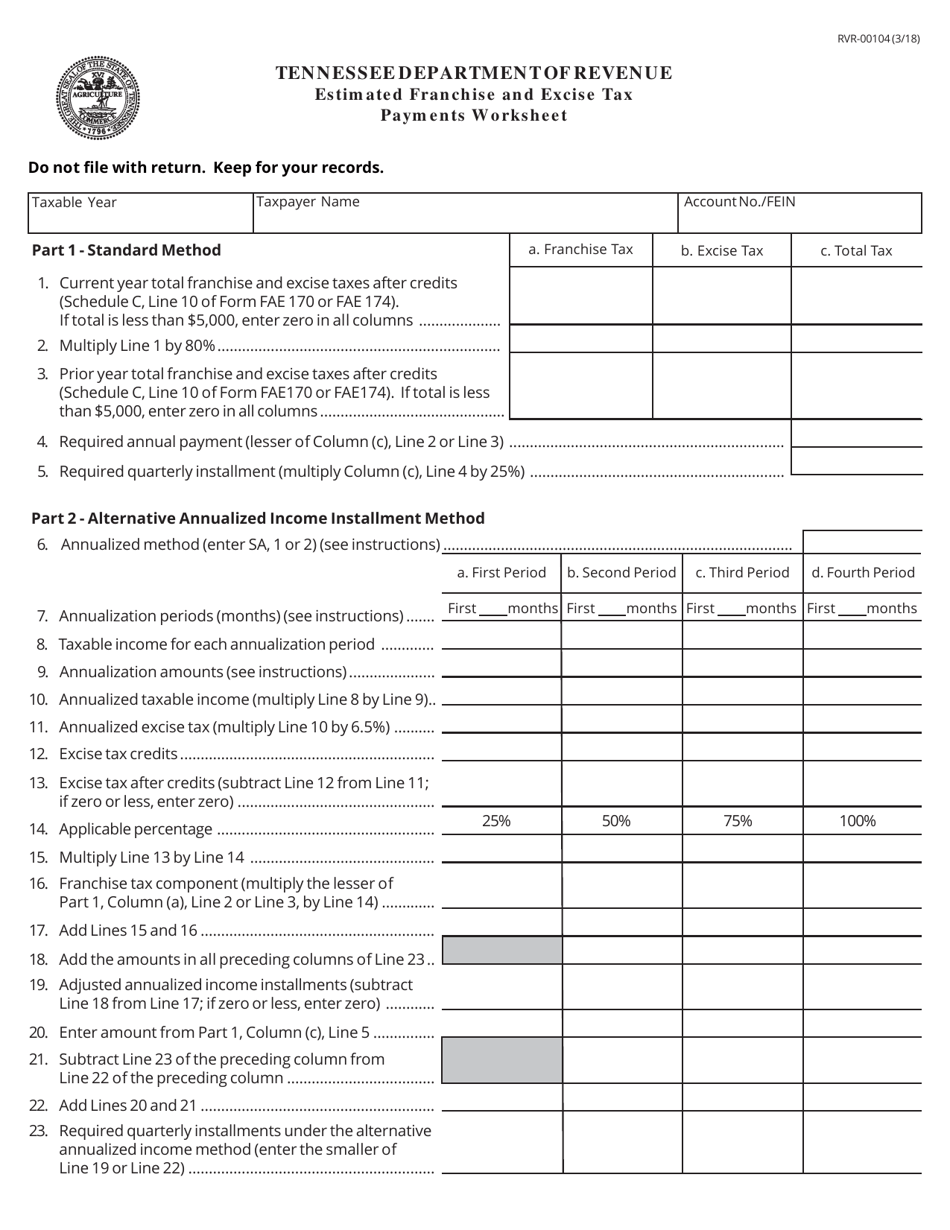

FE-13 - Estimated Tax Payments Due Dates and Penalty. See instructions Form CT-3-I before completing return. The Franchise Excise Tax return can be extended for six months provided the taxpayer has paid by the original due date at least 90 percent of the current years tax liability or 100 percent.

The excise tax is based on net earnings or. All filers must enter tax period. So calendar year franchise and excise returns will have an extended due date of Nov.

How do I pay my Tennessee franchise and excise tax. For business with a 11-1231 calendar year this tax is due on April 15th of the following year. The franchise tax is based on the greater of net worth or the book value of real or tangible personal property owned or used in Tennessee.

The department has also extended the franchise and excise tax due date from April 15 2021 to. Tennessee business tax returns are due by the 15 th day of the 4 th month after the close of the tax year. The following will cover certain aspects of Tennessees Franchise and Excise tax and give particular focus to the more common exemptions available under the taxing statute.

No further action is required. If you cannot file on time you can get a. Payment enclosedPay amount shown on Part 2 line 19c.

For example a calendar year taxpayers return is due on April 15. Estimated payments are due on the 15th day of the fourth sixth and ninth month of the current tax year and the 15th. The due date now aligns with the extended federal Form 990-T deadline.

For franchise and excise tax the extension only applies to individuals who file a Tennessee franchise and excise tax return using Schedule J2.

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Covid 19 Tn Department Of Revenue Extends Certain Tax Deadlines Ucbj Upper Cumberland Business Journal

Tennessee Revenue Department Extends Some Tax Deadlines To May 17 Wate 6 On Your Side

Tn Dor Fae 173 2017 2022 Fill Out Tax Template Online Us Legal Forms

Tennessee Tax Resolution Options For Back Taxes Owed

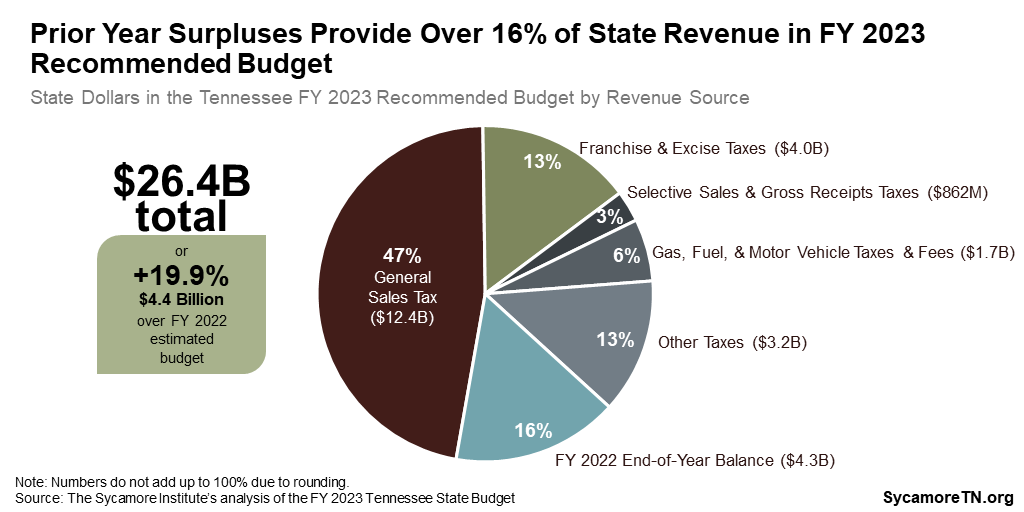

Summary Of Tennessee Gov Lee S Recommended Fy 2023 Budget

Tennessee Clarifies The Application Of Marketplace Facilitator Legislation To Franchise Excise Tax Forvis

Fill Free Fillable Forms State Of Tennessee

![]()

Monthly Tennessee Tax Revenue Tracker For Fy 2020

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Tax Filing Payment Deadlines Extended As Part Of Covid 19 Relief Gallatinnews Com

Incorporate In Tennessee Do Business The Right Way

Tn Dept Of Revenue On Twitter Reminder 2017 Hall Income Tax Amp Franchise And Excise Tax Due Tomorrow Go To Tntap Https T Co Ieyohtca37 To File And Pay Servingtn Tnrevenue Https T Co Tltkcb4zb0 Twitter

Form Rvr 00104 Download Printable Pdf Or Fill Online Estimated Franchise And Excise Tax Payments Worksheet Tennessee Templateroller

S A L T Select Developments Tennessee Baker Donelson

Tennessee Department Of Revenue Facebook

Governor Signs Bill Exempting Certain Covid 19 Relief Payments From Tn Excise Tax Nfib